Integrated payments

One powerful payment platform, multiple ways to transact

Reduce friction, hurdles and frustration when transacting with your clients, anytime, anywhere.

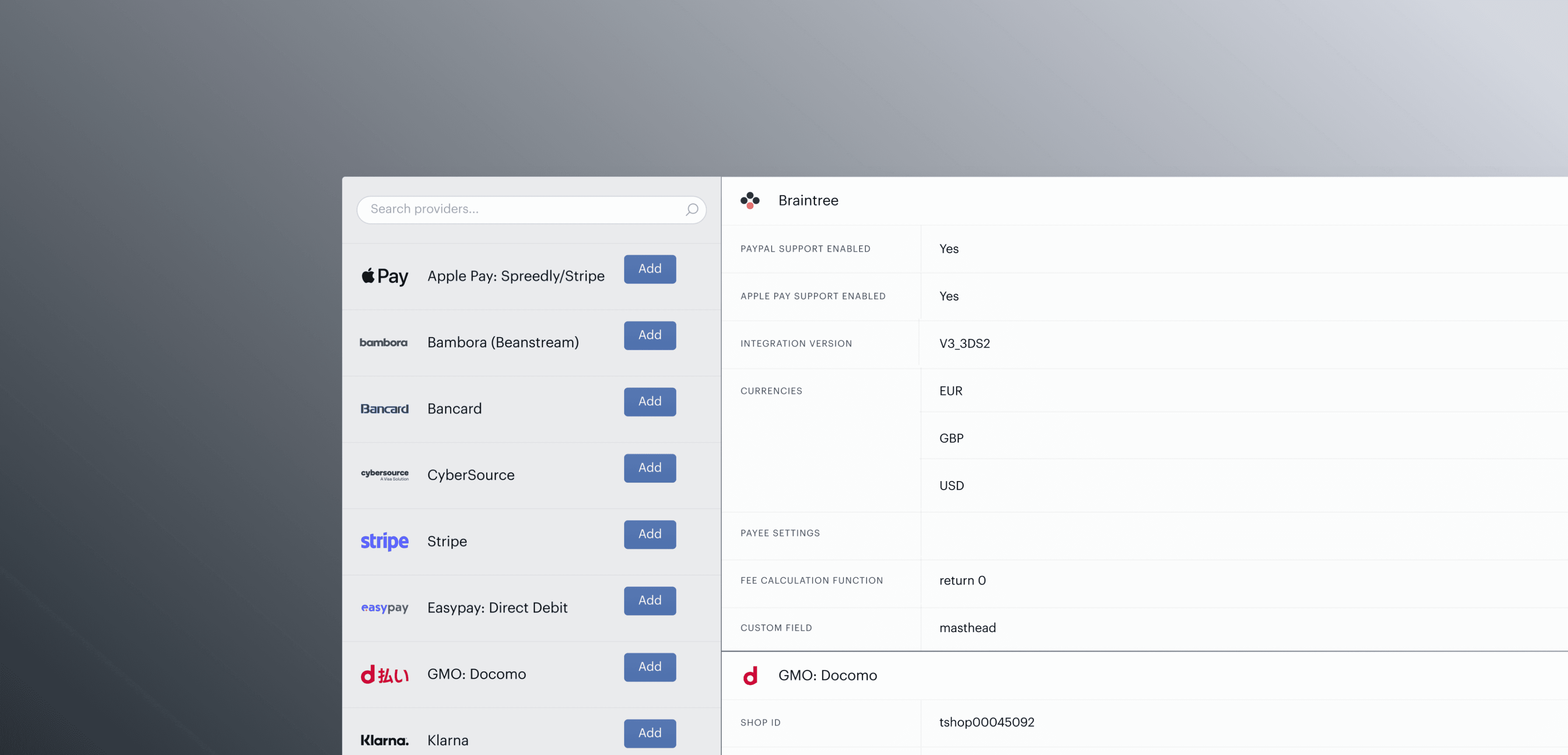

Leverage over 80 feature connections and 35+ payment methods across multiple regions, such as credit and debit cards, PayPal, Venmo, Apple and Google Pay, SEPA, BACS, ACH, IDEAL, Sofort, Bancontact, Invoicing, mobile and local payment methods in various regions.

Easily launch promotions and offers within checkout and end-user interfaces without redeploying code, while built-in tax compliance and authentication help streamline your operations.

Target local providers by region, control payment methods and currencies, while delivering a frictionless, global experience.

Enable users to manage their payments with a customizable wallet widget to manage transaction lifecycles. Utilize Account Updater functionality and seamlessly integrate with Network tokenization to guarantee effective management of recurring business processes.

Monitor each payment transaction, generate revenue reports, and conduct post-reconciliation effortlessly, while leveraging integrated reporting capabilities without the need for extra tools or development.

We stay abreast of industry changes and regulations such as PSD2 / PSD3, RBI regulations, card scheme frameworks and guidelines, security and API version updates, so you are ensured continuous compliance and reduced friction.

Protect against fraud and carding attacks with ongoing monitoring, rate limiter rules, user verification and more.